Diminishing value method of depreciation formula

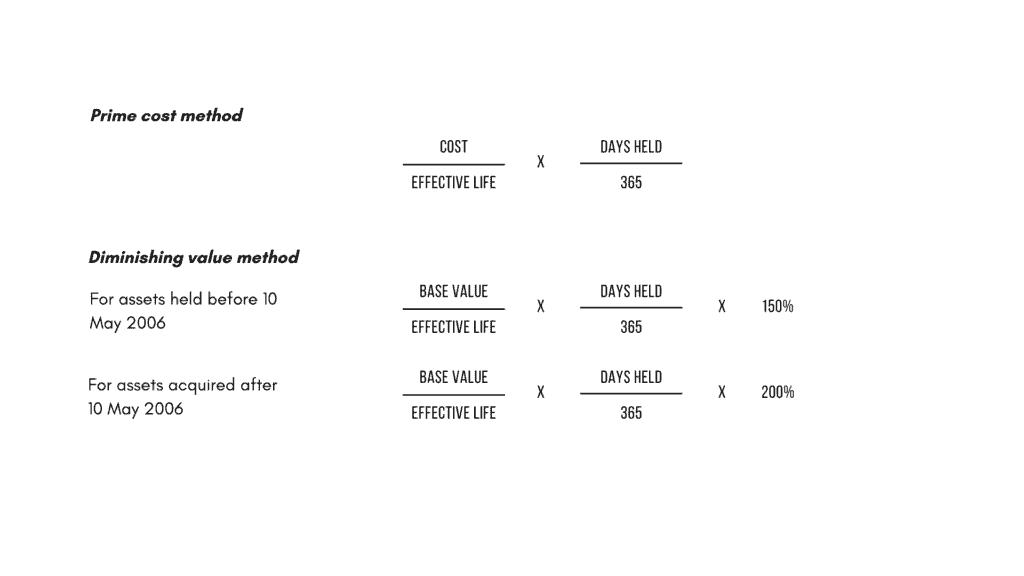

As you can see the prime cost depreciation method affords a fixed rate of depreciation. In the diminishing value method for calculating the depreciation thedepreciation charge is made every year at a fixed rate on the diminished valueof the equipment ie.

Depreciation Highbrow

Calculate the depreciation expense using the following formula.

. For example consider the initial cost of an equipm See more. Year 1 2000 x 20 400 Year 2 2000 400 1600 x. Sum of years n 2 n 1 Annual depreciation at 1st year FC - SV n Sum of years Annual.

In diminishing balance method depreciation is calculated on book value of the asset at the start of the year instead of principle amount with fixed percentage. Use the diminishing balance depreciation method to calculate depreciation expenses. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

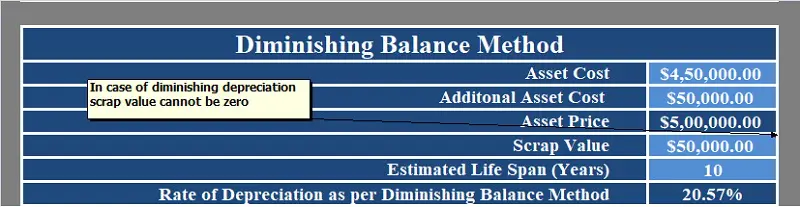

So Total Cost of an asset 110000015000050000 Rs 1300000- The following table shows the year by year. 1- sc 1 n X 100 Where s is the scrap value of the asset c is the cost of the asset and n is the useful life of the asset. Subtract the depreciation cost.

Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation youve. Depreciation Expenses Net Book Value. Depreciation formula diminishing value Friday September 9 2022 Edit.

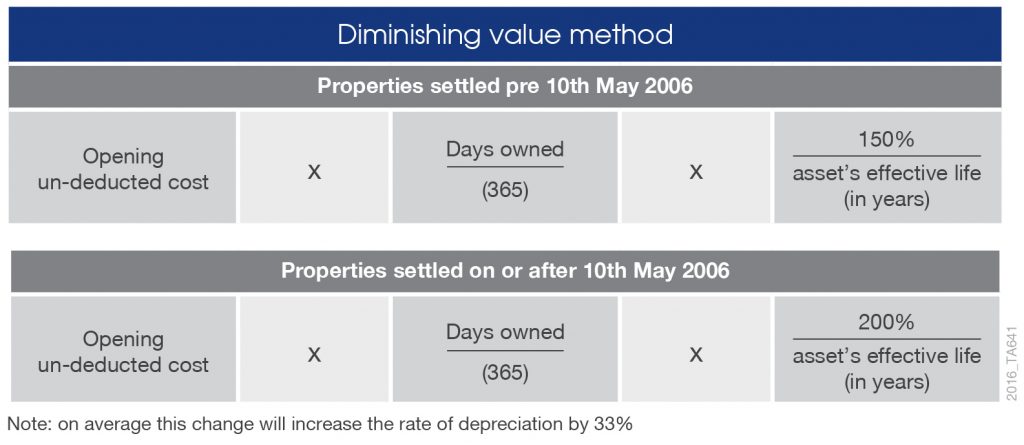

It is a variant of the diminishing balance method. Base value days held 365 150 assets effective life Reduction for. The rate of Depreciation 10 Year ending 31 March.

The formulas for the Sum of the Years Digit Method of Depreciation are. Depreciation Original cost Residual Value x frac No. In contrast the diminishing value method has a more significant upfront.

According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset. Cost value diminishing value rate amount of depreciation to claim in your income tax return The. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method.

Well here is the formula. Calculation of depreciation rate under diminishing balance method. With the diminishing balance method depreciation is calculated as a percentage on the book value of the tangible asset.

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. This means the current. Diminishing value method Another common method of depreciation is the diminishing value method.

Of years of the remaining life of the asset including the current year Sum of the. The diminishing balance depreciation method also results in a lower depreciation expense in. As the book value reduces every year it is also known as the.

It is difficult to calculate optimum rate of depreciation But we can use following formula for calculating depreciation in WDV. Lets say you re-carpet. Recognised by income tax.

R 1 SC 1n R rate of depreciation S S is. Under this method the asset is depreciated at fixed percentage calculated on the debit. The depreciation rate is 60.

The rate of depreciation is 30 percent. Rate Adjustments - Diminishing Value Depreciation Method Example. Net Book Value - Scrap Value Depreciation Rate.

The depreciation charge is first applied to the initial costof equipment and then to its diminished value. Diminishing balance method is also known as written down value method or reducing installment method.

Diminishing Value Vs The Prime Cost Method By Mortgage House

Depreciation Formula Examples With Excel Template

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Depreciation Diminishing Balance Method Youtube

Written Down Value Method Of Depreciation Calculation

Written Down Value Method Of Depreciation Calculation

How To Use The Excel Db Function Exceljet

Working From Home During Covid 19 Tax Deductions Guided Investor

Depreciation Diminishing Value Method Youtube

Written Down Value Method Of Depreciation Calculation

Straight Line Vs Reducing Balance Depreciation Youtube

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Depreciation Formula Calculate Depreciation Expense

Accounting Practices 501 Chapter 9 Ppt Video Online Download

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It